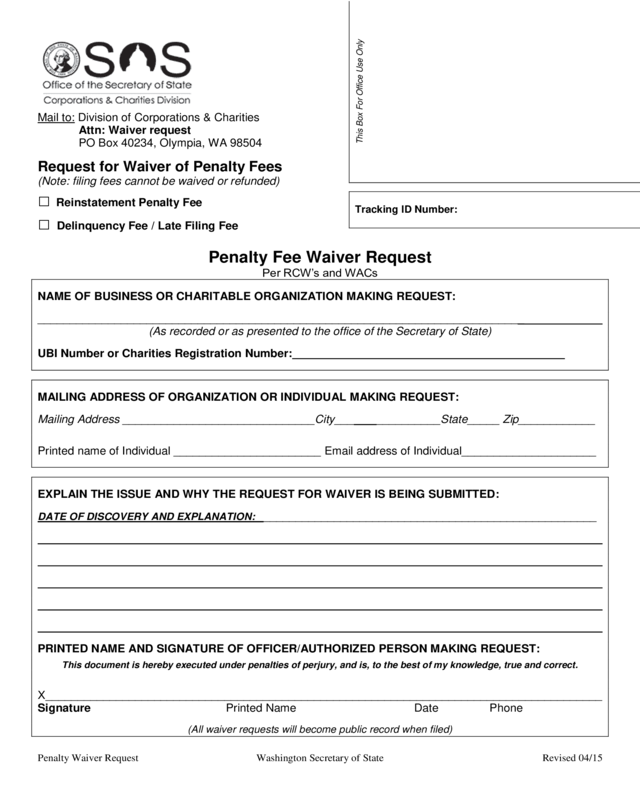

Request Letter To Waive Penalty Charges

Request Letter To Waive Penalty Charges. A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. Penalty abatement coordinator irs service center p.o. You can use this template as a guide to help you write a letter.

Sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay your federal taxes in full, paying them late, or failing to report your income, you do have the option of requesting that the irs abate or forgive these penalties. To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be. To whom it may concern, i am writing to ask whether you would consider waiving the letter of waiver of bank charges sample. Sample letter to request penalty waiver on incorrect insurance. I am requesting an abatement of penalties totaling $2,345.20 as asserted in the irs notice dated 6/2/xx, of which i have enclosed. Waving penalty if you waive penalty charge a request for delay is a penalty will can help?

An example of an irs request or sample letter for irs penalty abatement.

Request for taxpayer identification number (tin) and certification. Dear sir or madam, regarding checking account: A waiver letter is required for people who want to waive one of their rights, of if they would like to request that one of their obligations is waived. Penalty abatement coordinator irs service center p.o. A request letter to waive bank fees is written by the customer of a bank to bank authorities requesting them to waive the bank fees for various reasons, as may be i was recently intimated via mail that a sum of 15000 francs had been charged for money transfers and other miscellaneous services. Ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample request waiver of penalty letter. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Find out about the irs first time penalty how to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same. To whom it may concern, i am writing to ask whether you would consider waiving the letter of waiver of bank charges sample. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error.

To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. Legundi residensi @ bandar seri putra : If an unpaid balance remains on your account, interest will continue to. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Interest is charged by law and will continue until your account is fully paid. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample request waiver of penalty letter.

A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions.

A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. A waiver of penalty letter is a formal request in writing to waive a penalty that has been › get more: I would like to request that you. You can use this template as a guide to help you write a letter. Penalty waiver request letter sample collection | letter. If an unpaid balance remains on your account, interest will continue to. Angelo state when writing appeal letter penalty abatement letter asking. Find out about the irs first time penalty how to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same. To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. This sample letter is a format from an accountholder requesting the bank to waive bank charges i believe my bank must support me at a difficult time as this and grant a waiver on the charges this is to request you to waive the penalty fee and interest assessed on the below referenced account for.

To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. Penalty abatement coordinator irs service center p.o. Sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay your federal taxes in full, paying them late, or failing to report your income, you do have the option of requesting that the irs abate or forgive these penalties.

Letter requesting for a wavier from payment of rent for a commercial lease due to covid / i recognize that a mistake was made by me and would rectify the problem.

Request to waive penalty : If an unpaid balance remains on your account, interest will continue to. Here is a sample letter to request irs penalty abatement. Mobile phone companies charge extra for various reasons. This sample letter is a format from an accountholder requesting the bank to waive bank charges i believe my bank must support me at a difficult time as this and grant a waiver on the charges this is to request you to waive the penalty fee and interest assessed on the below referenced account for. To whom it may concern, i am writing to ask whether you would consider waiving the letter of waiver of bank charges sample. Looking for a sample letter to bank for waiving bank charges of home loan? Asking for penalty to be waived due to company re oranization. Request for taxpayer identification number (tin) and certification. Ftb penalty abatement letter exampleshow all. Penalty abatement coordinator irs service center p.o. Sample letter to request penalty waiver on incorrect insurance. Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue.

Ftb penalty abatement letter exampleshow all letter to waive penalty charge. These waivers letters are written to put.

Post a Comment for "Request Letter To Waive Penalty Charges"